Regular cash flow projections and comparison to actuals

Cashflow refers to the movement of money into and out of business, and it is one of the essential financial indicators for the business. This is why a proper financial record keeping is so important.

Cashflow refers to the movement of money into and out of business. Imagine your business as a car. Cash is the petrol of the business that allows that business to operate. The petrol you put in helps drive your business forward – provide products and/ or services to your clients and pay your debts as they become due and payable. So, when you run out of petrol, your business is in trouble – it becomes insolvent. In practice, you might not always have a full tank. Keeping tabs on your tank level through accurate and regular checks will ensure the engine doesn’t stop running.

This is why financial record keeping is so important for all businesses.

However, many small-to-medium-sized businesses (SMEs) do not consider budgeting/ forecasting as anything more than an afterthought. Business owners that are operating without a formal strategic financial plan are not doing their business or themselves any favours. It is impossible to track how far your business has come when there is no means of tracing your company’s financial progress. This becomes particularly problematic during a period of financial crisis. Why? If you can’t measure it, you can’t manage it. Without detailed and accurate financial information, it is impossible to assess where your business is falling short and to find areas of strength to build on.

Here we look at a range of budgeting/ forecasting methods and evaluate which best suits SMEs in crisis.

Why profit and loss statements won’t help you understand the future needs of your business

When facing adversity, your accounting statements from last month won’t help you. They are historical records, not projections. Using historical profit and loss statements is like trying to find treasure with a century old, hand drawn map. Without clarity and detail, you may get close to what you want, but it’s unlikely you’ll uncover any treasure. It is the same for profit and loss statements. They show only the past and thus only provide a general guide to future performance.

Before going any further, let’s clarify what we mean by a profit and loss statement. A profit and loss (or income) statement lists your sales and expenses. It tells you how much you have made or lost historically. As a business owner, you might complete a profit and loss statement every month, quarter or year. Usually, a profit and loss statement will include figures on the following items:

- Sales

- Expenses

- Total expenses

- Net profit

It is important to note that profit does not equal cash at bank. You can make profits and still have no money at bank as it is down to timing.

Profit and loss statements are essential scorecards of financial success. You can use your profit and loss statement to help develop sales targets and an appropriate price for your goods or services. Together with balance sheets and cash flow statements, profit and loss statements provide an in-depth look at a company’s financial performance over a year. However, their utility is limited in times of significant financial hardship because they only look backwards.

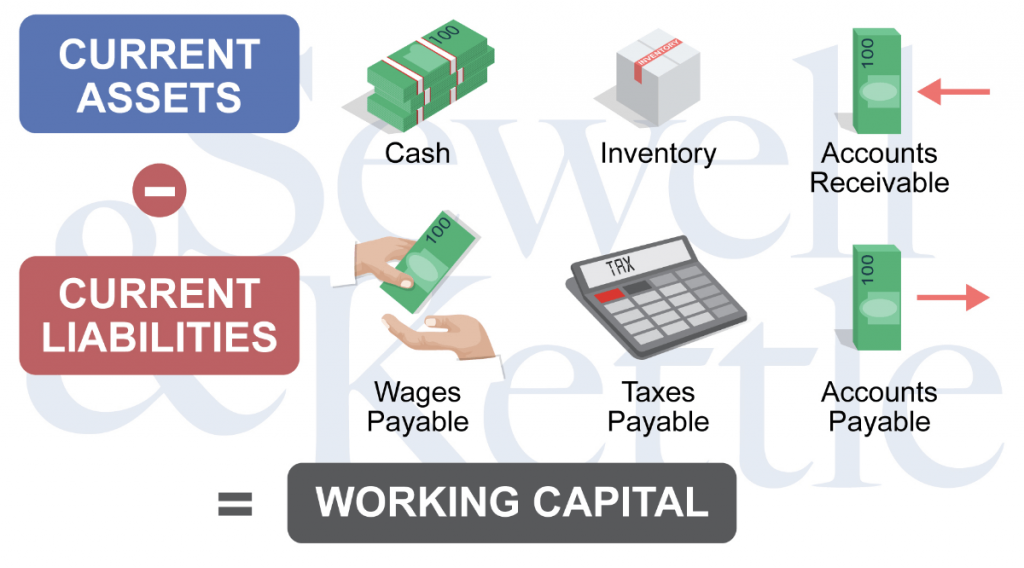

When your business is experiencing a serious and potentially fatal decline, a profit and loss statement will not do the job of planning for a turnaround. In a time of crisis, there needs to be a focus on working capital levels. Working capital is the difference between a company’s current assets and current liabilities, it indicates the business’ ability to meet its short-term debt obligations. Without sufficient working capital, a business is vulnerable to running out of cash. This is an important metric to consider in a period of financial hardship, yet it cannot be adequately determined using only profit and loss statements.

In a time of crisis, you must also be able to build strategies for the future that will lift your business from its downward spiral. Survival is often about reducing expenses. Expected income coming from your product/ service is harder to control, so for most businesses the way out of financial strife is through a reduction of non-essential expenses. For a business to do this, and to in turn survive, it needs to look at projections and plan strategically. A detailed, rolling cash flow projection will help you understand how much cash you may or may not have in the coming months and where and how you can cut expenses. As such, future projections, rather than historical records, are necessary to

guide your business strategy in a time of crisis. Projections will assist you in planning for the best outcome possible.

How to create a detailed, rolling cash flow projection

A rolling cash flow projection is a report that uses historical data and human judgment to predict the future position of a business on a continuous basis. They are frequently used for forecasting, supply chain management, and financial reporting purposes because they provide a more accurate view of a business’ financials than static forecasts. Beyond this, using a rolling cash flow projection can improve a business’ agility in the market, enable more accurate financial planning given the focus on future income and reduce short term liquidity risks by providing management with more certainty upon which to base their ongoing business strategy.

With all these benefits, it is important for business owners to understand how they can create rolling cash flow projections for their own business.

The process of creating a rolling cash flow projection is similar to the way you might build other forecasts. The key difference is that this method requires you to update your data regularly to ensure that it provides the visibility you need. At its most basic, creating a rolling cash flow projection requires the following steps:

- Determining the forecasting objective

- Selecting a forecasting period

- Selecting a reporting period

- Sourcing your data

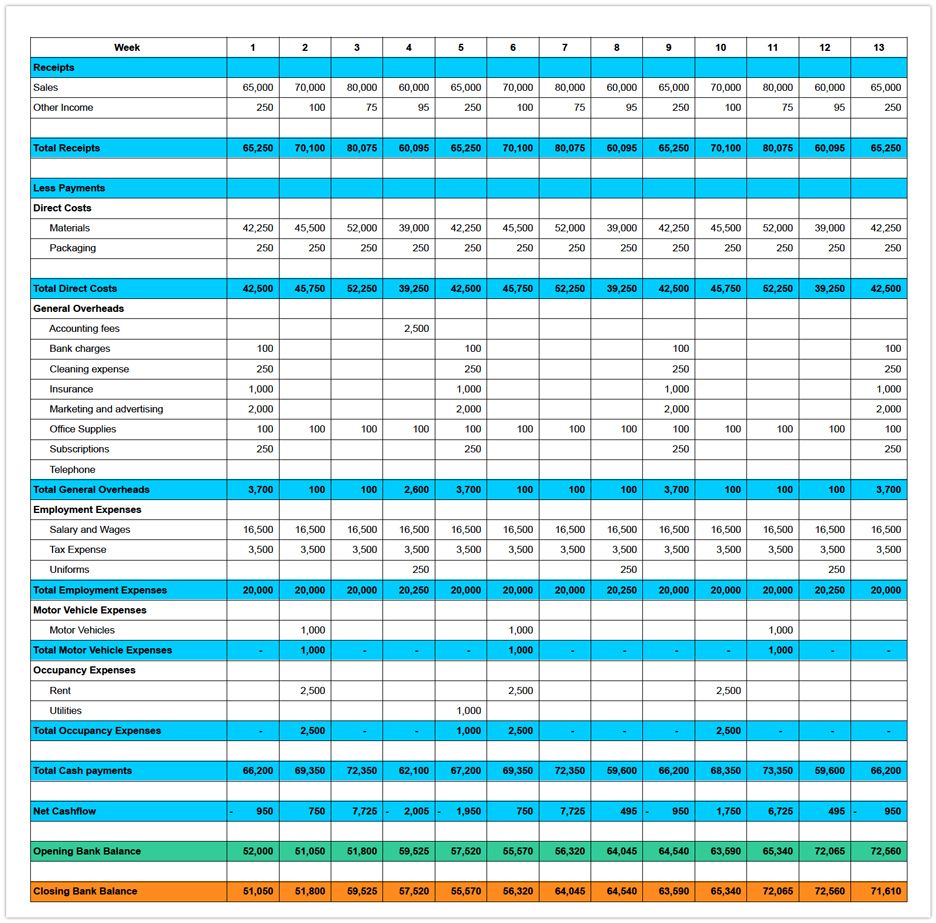

Dominic Aversa in his 2019 book, ‘Corporate Undertaker’, recommends creating a detailed 13-week cash flow. He argues that only a detailed, rolling cash flow projection will help you understand how much cash you may or may not have in the coming months. Without such information, you will be fighting an uphill battle against your business’ financial problems.

We have created a sample 13-week cash flow forecast.

If you want to download this example, click on the button below.

Reconciling cashflow projections against actual results

In addition to the work done above, every month you should reconcile your cashflow projection against actual results. This process involves using financial data to assess how closely your company’s spending and generated revenue meets the financial forecasting projections included in your forecast. By taking the time to conduct this comparison, businesses can determine the following:

- whether there are areas that need more funding;

- whether the cashflow is realistic; and,

- whether your business is on pace to meet its long-term objectives.

Ultimately, this will help you fine-tune your projections and stay on top of issues in a timely manner.

We recommend ensuring that your accounting software package such as MYOB or Xero is fully reconcilable each week. Accurate and comprehensive bookkeeping will allow you to see what figures you are working with. This will be essential in ensuring your financial records are comprehensive, accurate and ordered.

Conclusion

Strong financial planning is essential for any business, but during a time of crisis there must be added emphasis on creating accurate and strategic financial plans. Standard profit and loss statements and historical financial statements will not help you understand the future needs of your business. It is imperative that you focus on creating future projections that will help you assess where your business is falling short and to find areas of strength to build on.

At the end of the day, cash is everything in a business survival scenario. You can have the best projections and systems in place but you need money in the bank to make it out the other side. Cash is king. You will give your business the best chance to get cash flowing back into your business if you have the necessary information and plans in front of you. So, make sure your strategy is based on the best financial information available to give your business the best shot at survival.