Client Journey: When Tax Debt Accrues

As the largest creditor for most small businesses in Australia, ballooning tax debt poses a real risk of corporate insolvency or bankruptcy.

In article:

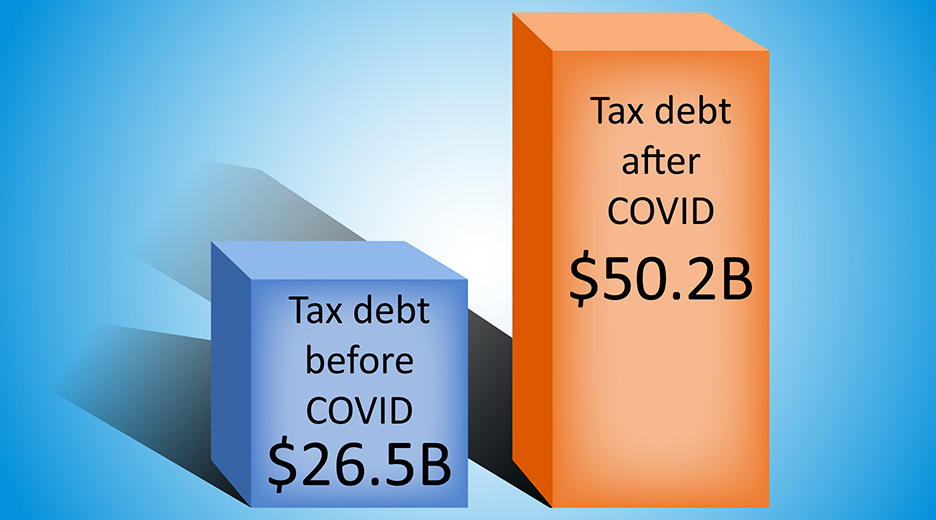

The tax owed by small businesses has increased radically in recent years. The ATO reports that collectible tax debt increased from $26.5 billion in June 2019 to $50.2 billion in June 2023 — an increase of 89 percent. Of this debt, small businesses are over-represented owing $33 billion of the $45 billion of collectible business debt.

Given the size of this debt and the ATO’s commitment to enforce this debt more rigorously, small businesses need to decide how to respond to this debt. Arguably, the ATO represents a ‘bank’ for many small businesses in Australia with tax debt not feeling ‘real’ in the same way that other debts do. It comes as no surprise then that most SME insolvencies have the ATO as the largest creditor.

Here we look at what you need to do if you have accrued a large tax debt.

Types of tax debt in Australia

The Australian Tax Office is the biggest creditor in Australia: On a regular basis businesses must submit the following:

- ‘Pay-as-you-go’ (PAYG). This is a withholding of income tax payments of employees.

- Superannuation Guarantee. Employers pay mandatory Superannuation amounts to dedicated funds on behalf of their employees in addition to wages. If they fail to do so, they become liable for Superannuation Guarantee Charge to the ATO.

- Non–employment taxes. Companies must also regularly submit corporate income tax on any profits, and goods and services tax (GST) payments.

As with debts to other creditors, the ATO can initiate the winding up of a company if there is unpaid tax debt. But even besides the insolvency risk, it is worth bearing in mind that some debts, like unpaid Superannuation, are a real risk for prosecution and reputation damage – do you want your business to be on A Current Affair for not paying a kid their Super?

How tax debt accrues in Australia

Why is tax debt accumulating at such a rate for small businesses? There are a few factors:

- Quarterly payment dates. Generally tax is owed quarterly, rather than monthly like regular bills. For any business that is struggling financially, it feels sensible to prioritise the more immediate debts such as employee payroll.

- Flexibility of the ATO. The ATO, as an agency of the federal government is motivated by the public interest and does not want to see businesses closed down unnecessarily. This can, perhaps, lead to perception of small businesses that the ATO is ‘soft’ and will accept delays in paying tax due. This was especially so during the pandemic where the ATO was focused on stimulus payments rather than tax collection.

- Access to finance. Large corporates have access to capital markets whereas small business has more limited avenues to raise capital.

But with the ATO making it clear that it will be pursuing tax debts more intensely than before, any businesses with tax debts, or that may have tax debts, need to take action as soon as possible.

What will the ATO do if you don’t pay?

Where you have not paid the ATO, their first step will be to apply the general interest charge on any unpaid amounts, and contact you about the amount owed. They will also first use any future refunds or tax credits to repay an amount owing.

Where you still don’t pay, the may do one or more of the following:

- Refer the debt to their debt collection agency

- Issue a statutory demand for payment of debt (thereby beginning the path to potential liquidation)

- Issue a Director Penalty Notice (for unpaid PAYG, Superannuation Guarantee Charge or net GST)

- Issue a garnishee notice to banks or financial institutions to obtain payment from money held there

- Initiate liquidation by applying directly to the Court.

What to do if you owe the ATO?

If you have a business tax debt, or feel you may have an unmanageable future tax debt, we recommend that you take the following steps:

- Full bookkeeping writeup. First you need to get to grips with exactly how much you owe. Don’t go simply off what the ATO is demanding, as that will not be up-to-date. Also be sure to forecast your future tax debt as accurately as possible (you shouldn’t just focus on the current debt, only to accrue more debt in future).

- Check whether any ATO demand is correct. Seek specialist advice on any demand for payment of debt or Director Penalty Notice to check all is in order.

- Make early contact with ATO. As observed earlier, the ATO have the public interest as their guide and are more likely to be lenient or flexible when contacted promptly.

- Seek a payment plan with ATO. In a payment plan, you will agree to pay the amount owed over a set period of time, and in return the ATO will refrain from pursuing further action.

- Negotiate interest and penalties. The ATO has an official process for considering remission of interest in extenuating circumstances.

- Put policies in place to prevent tax debts accruing in future. It is worth reflecting on whether tax debt is a symptom of an unsustainable business model. You may need to make wider strategic business changes to ensure is sustainable and doesn’t have these problems in the future.

- Put in place asset protection measures. This ensures that in the event of insolvency your assets can be protected as much as possible. For example, some businesses may benefit from a trading trust arrangement.

Dealing with tax debts

Tax is one of those things that can become inherently scary to small businesses, and easy to put in the ‘too hard’ pile. With tax debts likely to continue to be a serious problem for small businesses, it is important for owners/directors to seek professional advice early and try and negotiate a solution with the ATO.