Client Journey: When Tax Debt Accrues

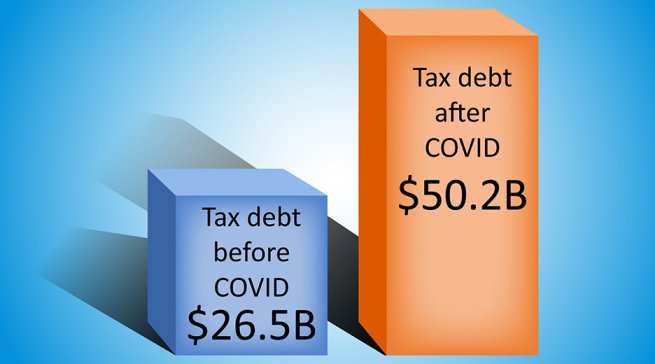

As the largest creditor for most small businesses in Australia, ballooning tax debt poses a real risk of corporate insolvency or bankruptcy.

As the largest creditor for most small businesses in Australia, ballooning tax debt poses a real risk of corporate insolvency or bankruptcy.

Rescue financing could be of significant help to financially distressed Australian businesses. Here, we explain why it is nevertheless difficult to get and suggest how things should change.

Employee theft is a major cost and risk for small businesses in Australia. Here we discuss why it occurs and what you can do to stop it.

Managing your expenses is one of the most important steps in maintaining cashflow. Here we set out some tips for small businesses to better handle expense pressures.

Many companies in Australia are not charging high enough prices for their business to be sustainable in the long run. Here we look at why businesses are doing this, and what they can do to improve the situation.

Australian business owners often embody a ‘do-it-yourself’ or ‘DIY’ mentality. While this is generally a good thing, here we look at situations where it might hold a business owner back.

Many small business owners struggle to delegate tasks. Here we suggest some practical steps for business owners to better delegate to their team.

When your business is in difficulty it is important that you can access reliable advice on what to do next. Here we look at the main contenders for reliable pre-insolvency advice.

Burnout — chronic physical and mental exhaustion — is a major problem for small business owners and the economy as a whole. Here we diagnose the key contributors to burnout in Australia and offer some tips for business owners to avoid it.

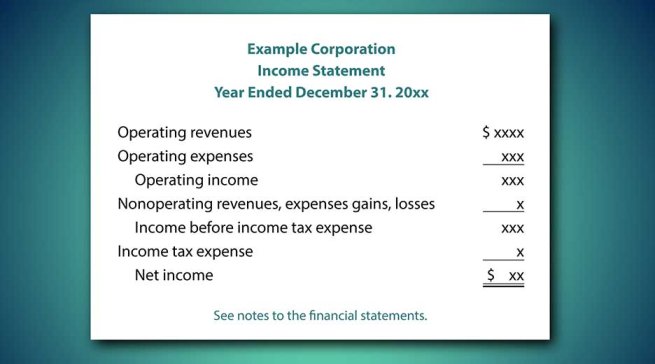

Financial record-keeping and preparing financial statements are vital activities for small businesses in Australia. However, financial statements don’t tell you everything. Here we look at what the balance sheet and P&L statements leave out.

It is a mistake to think that all business financial issues have external causes. Here we ask, what if the guy or gal is the fundamental problem?

By definition, a business is started in order to make a profit for the owners. But is that all it’s about? Here we look at why it is crucial to have a business purpose beyond profit.