Client Journey: Business growing pains and how to get through them

Most growing business will run into some challenges relating the growth. Here we take a deep dive into these business ‘growing pains’ and look at what small business owners can do to get through them.

In article:

The challenge of business growth

Businesses face different struggles at different points in their growth journey: The transition from micro-enterprise, to small business, and on to medium and large, is not straightforward. There will be growing pains at each step. Of course, this will be industry and business specific — in some cases it is harder to run a small business than a large business. However, if you are the founder and you can’t take a holiday because you’re too busy and worried about cashflow – you are probably in the ‘growing pain zone’.

In this piece we look at the form some of these growing pains take for smaller companies, and what you can do to overcome them.

Identifying the growing pains

Business growing pains can come in all manner of forms. Some of the biggest ones include:

- Cash flow challenges. A 2019 study from Intuit (now Intuit Quickbooks) found that 61 percent of small businesses struggle with cash flow, and nearly a third said they have been unable to pay their bills due to cash flow issues. These cashflow issues tend to compound as a business grows. For example, a small business owner may need to bring on staff to do jobs that they had previously done themselves (e.g., HR, accounts, payroll). This can mean a significant increase in recurring expenses before any accompanying increase in revenue. Or, if the business is selling a product, new suppliers or more complex supply chains may be required for selling goods at higher volume, again increasing costs before revenue has come in.

- Quality control. As volume increases, the owner will usually lose the ability to oversee all work directly themselves, which has implications for quality control. For example, the business owner may be able to directly ensure quality in one location, but not if the business has expanded to three locations. Another example is customer feedback: A small business owner may be able to directly respond to a customer complaint, but as the business grows, a more complex system may be required.

- Competition changes. As a business grows it may develop new competitors, or lose its competitive edge. For example, a small business may have local appeal as its “Unique Selling Proposition” but lose this as it goes regional or national. Relatedly, as the business grows, it may stop competing with other small businesses but compete directly with the largest players in the industry.

- Operational inefficiencies. Sometimes processes which worked when the business was smaller, will no longer work as the business grows. For example, managing inventory or accounts manually may be possible at a small scale, but impossible as the business becomes larger.

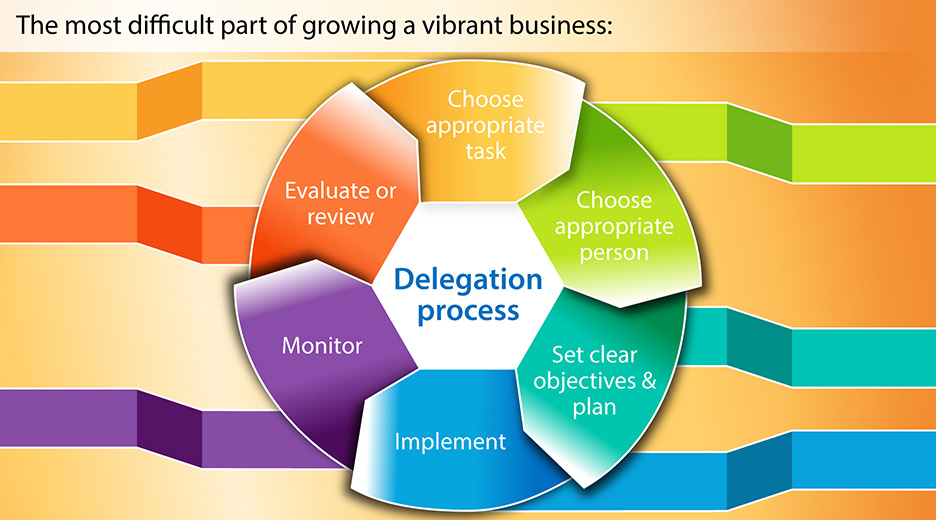

- Failure to delegate. Often a business owner is unwilling or unable to delegate tasks as necessary when the business grows. This may be due to a psychological desire to control business processes, or it may be that the business owner does not feel they can afford to delegate successfully. Either way, it means an over-worked and over-stressed business owner who doesn’t have the space to focus on business strategy.

What can help?

How can businesses alleviate their growing pains? Some useful steps for most business include:

- Develop scalable processes where they don’t already exist (for example automate and standardise inventory and accounts to alleviate the operational inefficiencies noted above)

- Get the right people in the right seats. This means both hiring the appropriate people and delegating all those tasks that can be delegated. Consider whether anyone can be put into leadership positions (to take the pressure off the business owner), and filling out staff with the right mix of employees and contractors.

- Implement systems thinking. This is a way of thinking that becomes essential as the business grows. Instead of seeing the businesses activities as a series of discrete and disconnected processes, the interdependencies between processes are emphasised. For example, a change to a product feature will have flow on effects for HR (who to hire to implement it) and marketing (how to integrate the new feature into existing marketing collateral). For some businesses, Enterprise Resource Planning (ERP) and project management software can be useful for tracking and reviewing analytics relating to business systems.

- Utilise accounting software and budgeting – by planning your business growth rate, you can control it (to some extent). Read more about how to do this with our guide to three-factor budgets, and our essential accounting checklist.

Growing your business without the pain

As a business gets bigger, growing pains are normal — the key is to take steps early to address them as quickly as possible. By implementing scalable processes, systems, and hiring the right people, most businesses can push through any issues and succeed.