Client Journey — What the financial statements don’t tell you

Financial record-keeping and preparing financial statements are vital activities for small businesses in Australia. However, financial statements don’t tell you everything. Here we look at what the balance sheet and P&L statements leave out.

Contents:

For the owners and operators of small businesses in Australia it is crucial to use the financial records and information in that business to best fuel business success. However, the financial statements are not everything. In this article we explore why financial statements matter, what their limitations are, and what you can do to look beyond the financial statements.

Why are financial statements important?

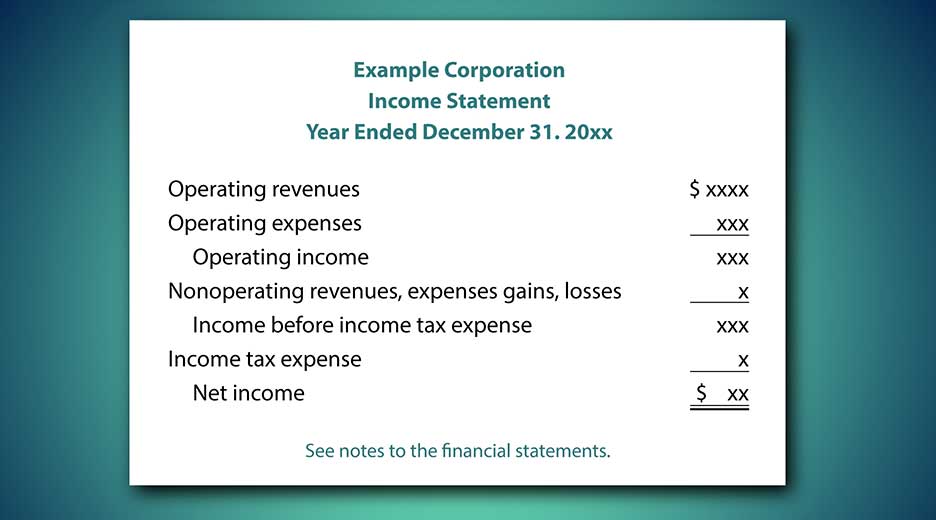

Unless the business is an accounting firm, preparing financial statements is not core business. In fact, for many small business owners, taking care of the books can go in the procrastination pile. But financial recordkeeping and the statements that are constructed from them (including the Statements of Financial Position, Financial Performance and Cash Flow) are important in ensuring ongoing business efficiency. The financial statements might be likened to a scorecard when playing Golf — they are not the point of the game, but rather the key tool for keeping track of what is going on in the game.

So why, specifically, do businesses need to bother with financial statements?

- Strategic decision-making. All business owners need to focus, and financial statements can be crucial in helping business owners work out what they need to direct their attention towards. For example, if accounts receivable is especially high, the business may need to focus on collections or better client selection; if profits are substantial, then the business may need to consider whether that profit is best re-invested to grow the business, or whether it should be distributed to shareholders.

- As a requirement of third parties. Whether seeking investment, loans, or looking to sell the business, financial statements will usually be required by third parties in order to assess the financial health of the business. Relatedly, if the business ever gets into financial difficulty, financial statements will be one of the first steps in a viability review.

- As a compliance requirement. Some companies in Australia must prepare financial statements and file them with the Australian Securities & Investments Commission (ASIC). This includes large proprietary companies and public companies, but also smaller companies that are foreign-controlled.

- Cash management. Financial statements may reveal ongoing problems with cash management — one of the most significant causes of financial distress for Australian businesses (read more in our guide to overcoming the challenges of Australian small business management).

What are the limitations of financial statements?

While extremely useful, financial statements do have their limitations. Namely:

- They are historical. As the financial statements are usually only prepared annually, they are often outdated by the time the accountant/auditors sign off on them. Financial statements need to go hand-in-hand with budgeting and ongoing cashflow analysis to ensure ongoing business viability.

- They are an overview only. Financial statements alone are just the starting point, and won’t go into enough detail to see the root cause of any issue (such as the aging of receivables)

- They can over-simplify. For example, unprofitability on a Statement of Financial Performance does not, in itself, indicate financial distress or insolvency. This is the norm for a cash-hungry tech startup with significant investment.

- It doesn’t capture most of the intangibles. For example, the human capital in the company (including an owner-operator’s own skills and experience) are not identified as the key business asset they are.

How to look beyond the financial statements

Given that there are a bunch of things that the financial statements don’t tell you about your business, what other steps should you take to improve financial information and its use in your business?

- Check bookkeeping practices/software which underlie financial data. Accounting software is helpful, so too is an accountant to keep track of performance. Note, while some small businesses try to save costs by outsourcing accounting overseas, this does pose a potential data risk for your company (in addition to the risk that Australian accounting requirements are not properly understood).

- Use real-time financial data to inform decisions, not just historical data. For example, by monitoring sales information in real time, a business owner might better manage inventory (by knowing which product lines are more popular), or review whether behaviour is changing in response to price changes.

- Consider cost accounting as well as financial accounting. Cost accounting attempts to capture the company’s true costs of production by assessing the input costs of each step of production, including the relevant share of fixed costs. This could help product-based businesses, for example, in ensuring prompt pricing decisions where the costs of production are rising. The company can assess profitability at various price points and volumes.

- Develop a set of KPIs to measure progress towards targets. This could cover things like the current ratio (comparing current assets to current liabilities, assessing the business’s ability to cover short-term obligations), operating cashflow (cash generated by ordinary operations) and accounts receivable turnover (how quickly customers/clients are paying their accounts — a lower ratio can indicate upcoming cash problems). These KPIs should be linked to a master budget for the business (read more in our guide to three-factor budgets)

Recap — what the financial statements don’t tell you

Financial statements are a crucial tool — both for the business owners and directors, and for third parties. But they are just that, a tool. They do not provide deep insights into the financial goings on of the company. For that, budgeting, forecasts and real-time financial information are crucial.