How successful has the small business restructuring process been so far?

The Small Business Restructuring Process (SBRP) was introduced in Australia in 2021 as a streamlined process for insolvent small businesses. The objective of the process is to allow small businesses to put a restructuring plan proposal to creditors without losing control of their business.

Introduction

The Small Business Restructuring Process (SBRP) was introduced in Australia in 2021 as a streamlined process for insolvent small businesses. The objective of the process is to allow small businesses to put a restructuring plan proposal to creditors without losing control of their business. The first set of results has been released in ASIC Report 756, which assesses the outcomes of the SBRP in its first 18 months. In this blog post, we will analyse the results and discuss the effectiveness of the SBRP for insolvent small businesses.

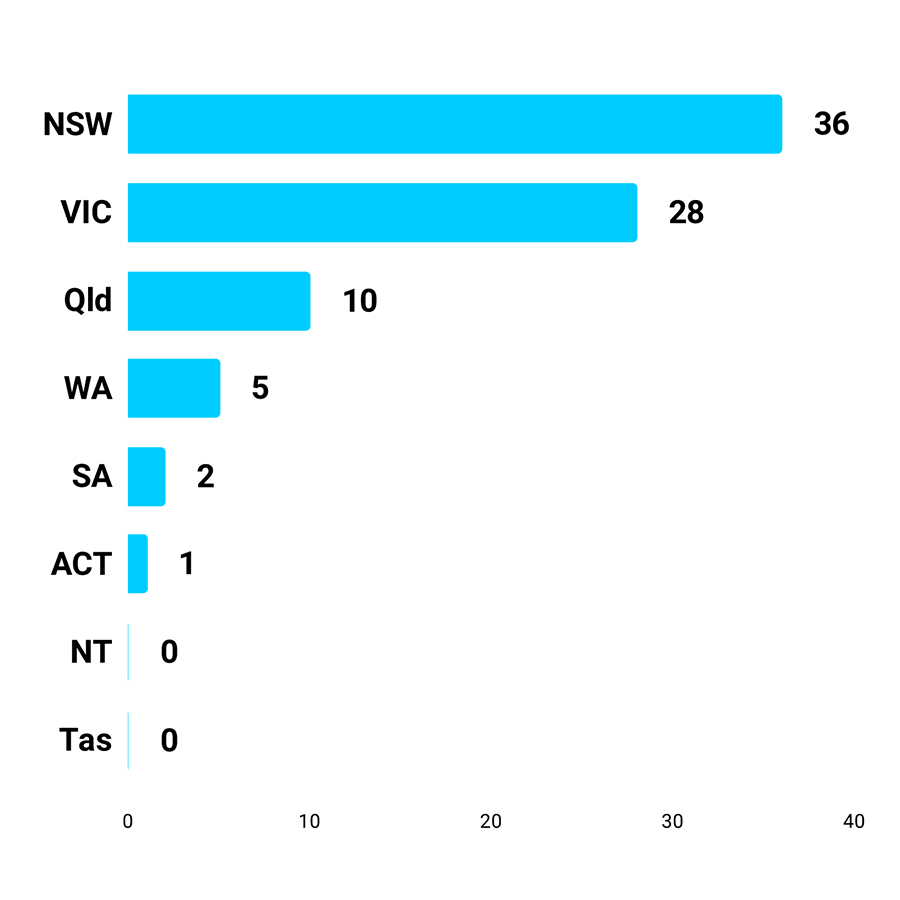

Low number of SBRP appointments

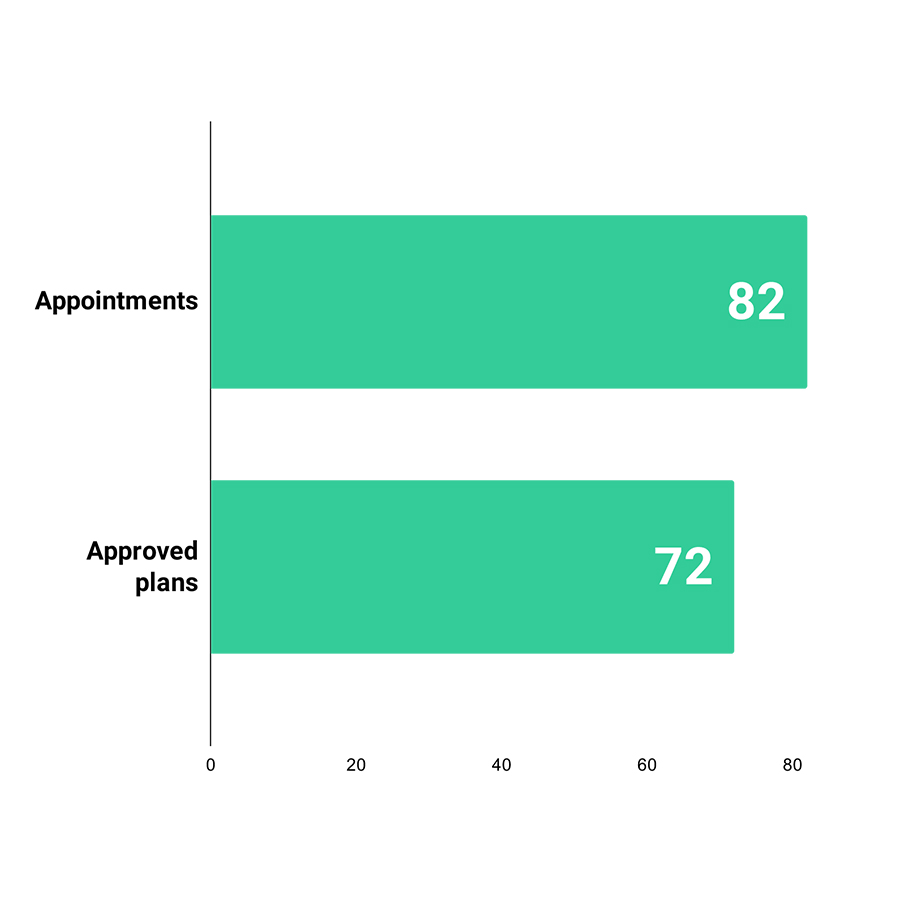

During the first 18 months of the SBRP, there were a total of 82 SBRP appointments, compared to 7,154 external administrations during the same period. The low number of appointments suggests that the SBRP might not be the first choice for small businesses facing insolvency, or that it might not be widely known or understood by small business owners. The SBRP process has the following benefits (compared to voluntary administration): Lower costs, less reporting requirements and no loss of director control over the business.

High approval rate of restructuring plans

Despite the low number of appointments, the proportion of restructuring plans approved by creditors is remarkably high at 87%, with 72 of the 82 appointments resulting in approved plans. This high approval rate indicates that the SBRP has been effective in helping small businesses restructure their debts and reach agreements with their creditors.

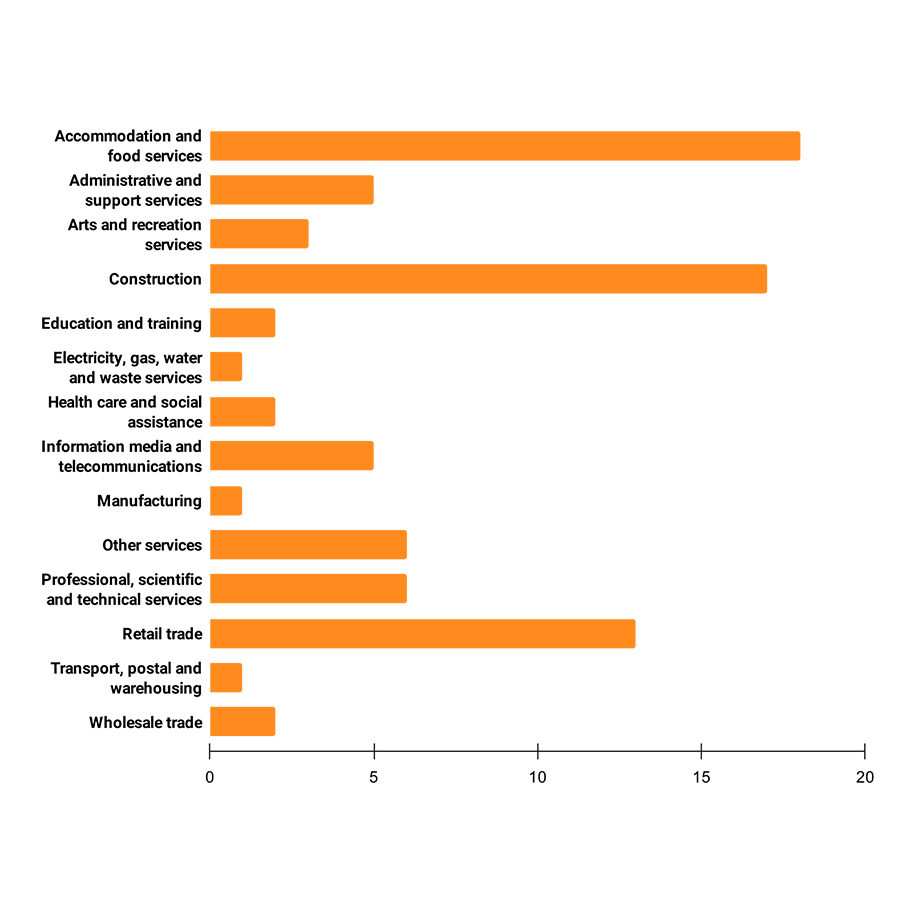

Diverse businesses utilizing the SBRP

A variety of businesses have taken advantage of the SBRP. The most common industries include accommodation and food services (21%), construction (20%), and retail (16%). This diversity demonstrates that the SBRP is applicable and beneficial to a wide range of small businesses across different sectors.

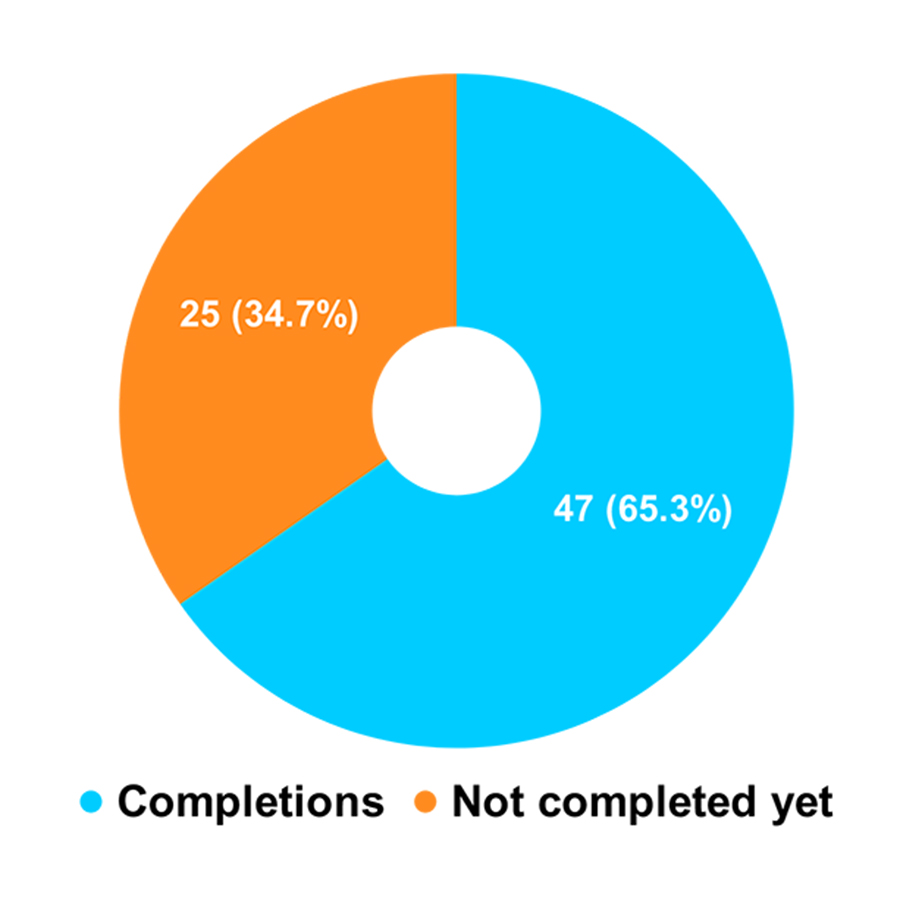

Successful completion of plans

Of the 72 accepted restructuring plans, 65% have been completed successfully by the companies as of September 2022. This number is expected to increase as the calculation is ongoing because restructuring plans can run for up to 3 years. The relatively high rate of successful completion suggests that the SBRP has been an effective tool for helping small businesses regain their financial footing.

Debt forgiveness in restructuring plans

The ASIC report does not provide a specific calculation of the proportion of debt forgiveness that small businesses have obtained through a restructuring plan. To estimate the amount of debt forgiveness obtained through restructuring plans, it is necessary to deduct it from other calculations in the report.

The restructuring plans involved a significant amount of debt forgiveness, with an estimate of 84.8% of the debt being forgiven. This estimate is calculated by subtracting the proposed dividend rate (15.2%) from 100%. It is important to note that the Restructuring Practitioner fees must be added to the total, with median remuneration of $22,055.

Key hurdles to success

While the SBRP has been successful in many aspects, there are still some hurdles that need to be addressed. These include building licensing issues, insurance ipso facto clauses, and statutory compliance issues. It is crucial for small business owners and their advisors to understand these challenges and consider them when deciding whether the SBRP is the right solution for their business.

Conclusion

In conclusion, the Small Business Restructuring Process in Australia has shown promising results in its first 18 months of implementation. Despite the low number of SBRP appointments, the high approval rate of restructuring plans, successful completion of plans, and significant debt forgiveness demonstrate the potential of the SBRP to effectively assist insolvent small businesses. However, there are still hurdles to overcome, and further understanding is required for small business owners to make the best decisions for their companies.

Frequently Asked Questions about SBRP

An example of restructuring is undertaking immediate stabilization when a business is in financial distress. Fixed costs may not be able to be reduced in the short term, such as rent or technology commitments, so the focus would be on expenses that can be reduced in the short term.

It is likely that labour costs (salary and wages) would be the first expense that any restructuring practitioner would look to reduce. The other aspect of restructuring would involve reviewing the working capital requirements of a business to ensure that it has adequate financing in place in the short term. Cash is king and in a financial distress scenario a business might become legally insolvent when it runs out of cash.

If the restructuring is a small to medium sized business it could take up to a year. If the business cannot be turned around it may be restructured through formal insolvency procedures such as the small business restructuring process or voluntary administration. If the formal insolvency process involved a payment plan that payment plan could run up to three years (in the case of small business restructuring).

Having an attractive underlying business model is the first factor that is crucial to having a successful restructure. Most SMEs don’t generate large profits for owners but a viable business needs to be capable of both paying the owners a decent return and also operating in a market that has decent prospects going forward.

The other factors include the enthusiasm of the owners and resources of the business. Most SMEs are service businesses and so the plant and equipment costs are quite low relative to the opportunity for returns that business owners have. This means that the key factor of production in an SME is usually the business owners themselves. The final piece of the puzzle is often whether the owners have the energy and strategic intent to renew their business after it faces a difficult restructuring process.

The exit option of company liquidation for a financially distressed business is the alternative to undertaking a restructuring. If a business isn’t viable and the owners don’t have the energy to go through a restructuring process this may be a better option. It may be a better option because the owners can stop injecting funds into the business and look at other opportunities. It is difficult to value this alternative but the opportunity cost of a restructure is the sum of the working capital to be injected and the alternative employment opportunities the owners have for future endeavors.

In a company liquidation the business ceases to trade and the assets of the business are taken into the hands of a liquidator. In contrast, in a restructuring the business continues to trade and it undergoes a process of reorganization and renegotiation with creditors. This restructure may be informal – undertaken in secret. Or it may be undertaken through a formal restructure process such as voluntary administration or small business restructuring. The key difference is that in a restructure the business keeps trading and the strategic intent of the owners is to save it from closure.

In a small business restructuring process, a restructuring proposal is usually written by the restructuring practitioner appointed. However, the actual offer is required by law to be very straightforward. It is required to be a cash payment to creditors and it may be paid through installments of up to three years. No property other than cash may be transferred to creditors, although a restructuring plan can involve the sale of business assets for the purpose of paying funds to creditors. The amount of the offer to creditors will most likely be a reduction in the amount owed overall and it is expected by stakeholders such as the ATO that this offer is higher than what would be obtained by creditors through a liquidation process.

It is likely that nothing will happen to them. It is unlikely that the director will face any legal sanctions. Immediately upon liquidation the company director will be required to co-operate with the liquidator and assist them with their investigations and collection of assets. The key legal risk to directors relates to whether the business was trading whilst insolvent for long before its appointment and whether any assets were inappropriately transferred. The liquidator has a positive incentive to make legal claims for recoveries of money and assets because it will result in a higher professional fee recoveries. On the other hand liquidators have no incentive to prosecute claims with poor chances of success because they will need to bear some risk for those claims and possibly lose money running the external administration.

To be a restructuring practitioner who can be appointed for small business restructuring they need to be an ASIC-registered company liquidator. Formally, this refers to an appointment as a restructuring practitioner of a company pursuant to part 5.3B of the Corporations Act.