Zombie Companies: Is your business walking dead? Complete Guide for SMEs

A zombie company is a business that barely scrapes by and is always short of cash. The problem with zombie companies is that they can be easily tipped over the edge into insolvency when something goes wrong. Read our article to learn more about the signs, symptoms and consequences of zombie companies.

- What is a zombie company?

- Explanatory video on zombie companies (2020)

- Where did the term ‘zombie company’ come from?

- Industries prone to zombie companies

- What mistakes do directors make?

- How do zombie companies get tipped over the edge into insolvency?

- How can zombie companies fix their problems?

- What has been the effect of COVID-19 on zombie companies?

- What will happen to zombie companies when support drops off?

- What is the impact of zombie companies on the wider economy?

- How should directors decide whether to restructure or wind up a zombie company?

- Causes and symptoms of zombification: John Argenti

- The three types of zombie company

- Company survival kit

- Cultural signs of a zombie company

- Case study: Darrell Lea

- Case study: Borders Books and Angus & Robertson

- Australian management problems

What is a zombie company?

A zombie company is a business that barely scrapes by and is always short of cash. In accounting terms, it covers most of its running costs but is never able to develop a profit margin.

According to BIS Oxford Economics, a zombie company can be defined as an operating business with a ratio of earnings before interest and tax (EBIT) to interest expenses below one. The lower the ratio, the greater the likelihood of the company failing.

The problem with zombie companies is that they can be easily tipped over the edge into insolvency when something goes wrong. Sometimes the analogy of the boiling frog is accurate – zombie companies move from one crisis to another without seeing that their financial position is getting worse – until they are finally boiled (financially). Insolvency is a position where the company is unable to pay its debts regardless of whether there is an uptick in sales forecast. The main takeaway is that the difference between a zombie company and an insolvent company is that while a zombie company is sick and might be dying, an insolvent company is terminal or already dead.

Large corporates (too big to fail) that become zombie companies often get bailed out – but this isn’t available to small-to-medium sized enterprises (SMEs: businesses with less than 200 employees, constituting 97% of all businesses in Australia according to the Productivity Commission). SMEs are allowed to fail and this can have devastating effects on the lives of company proprietors. The Australian insolvency system is usually tough on company directors of SMEs and the voluntary administration procedure is unlikely to help, because chances of genuine debt forgiveness are low.

Explanatory video on zombie companies (2020)

Where did the term ‘zombie company’ come from?

So where did zombies come from? The term ‘zombie company’ to describe a low profit, precarious business was first applied to Japanese firms which sought the support of national banks after the collapse of the Japanese asset price bubble in 1990. One of these firms, which employed almost 100,000 people was described by the then Japanese Finance Minister as being ‘too big to fail’, a phrase now often used when justifying a bailout.

In 2008, companies receiving bailouts as part of the US Troubled Asset Relief Program were referred to as ‘zombies’, ahead of the devastating effects of the Global Financial Crisis – the term has been widely used in the US since.

In 2016, China recognised the issue of ‘zombie enterprises’ and proposed to close and reorganise several key public industrial companies following the stock market crash.

Before 2020, ‘zombie company’ was not a term many Australians were familiar with. However, the introduction of several government and central bank policies designed to support businesses through the financial impact of COVID-19 and lockdowns has many commentators concerned about how many zombie companies are eating up resources and perpetuating debt. JobKeeper, bank payment extensions, looser enforcement of statutory demands and the extension of the safe harbour all allow zombie companies to keep trading, remaining dependent on high liquidity, negative interest rates and huge fiscal stimulus. ‘Zombie company’ is now a term Australians should endeavour to become familiar with.

Zombie companies are a moral hazard – they encourage and normalise uncommercial companies to continue trading, with negative effects on the economy. SMEs that are zombie companies are also likely to drain the energy and wealth of their owners.

Industries prone to zombie companies

SMEs are by nature brittle due to thin working capital and dependence on their owner’s wealth for support, and as such, they are highly vulnerable to becoming zombies. However, the primary cause of a zombie company is its industry. Zombie companies mainly crop up in mature industries where practices are well established, there are low barriers to entry, business is competitive, everyone knows the rules and margins can be squeezed by customers. Below are some of the key industries plagued by zombie companies:

- Building and construction companies: They are at the mercy of large builders and their tight cash flow means that if they lose one job they may be pushed into insolvency

- Transport companies: They have high capital and labour expenses (including insurance) and losing one big customer can push them into insolvency

- Retail and hospitality: Currently retail businesses are under enormous pressure from online competitors and the erosion of sales margins through other changes

- Professional services: High labour costs and market competitiveness means professional service providers of all types could become price takers

- Mining services: The mines push risk down on service providers so that they bear the risk of any downturn

What mistakes do directors make?

Directors often make a range of key errors in their responses to weak economic returns. These include:

- Working ‘in’ the business but not ‘on’ the business – what is the root cause of the problem after all? There is an important difference between the ‘symptoms’ of zombification (i.e. low profits) and what the true cause of these symptoms are. Only by addressing the true cause will the directors be able to execute a successful turnaround.

- Using expensive finance facilities such as receivables finance, caveat loans or credit cards to fund working capital shortfalls

- Failing to look properly at their corporate structure and continuing to invest sweat capital in an out-of-date structure

- Hiring the local solicitor and avoiding good quality lawyers who can develop a dependable litigation strategy

- Avoiding their accountant and bookkeeper and failing to make sure their accounting software is fully reconciled

- Putting prestige over profits by not focusing on the 20% of customers that deliver 80% of profit

- Avoiding conflict with employees by not managing by objective – trying to be mates not managers

How do zombie companies get tipped over the edge into insolvency?

Because zombie companies do not have the resources or strategies in place to account for unexpected developments, when these developments occur, they can tip zombie companies over the edge financially.

- Management issues – such as a breakdown in the relationship between the owners. This causes tension in the workplace, diverts the management’s attention away from the business and allows business management to fall by the wayside.

- Loss of important customer – if an important customer terminates their contract or a key contract is lost to a competitor, this will likely constitute an unmanageable drop in income for a zombie company. Without taking swift and decisive steps to cut costs or recoup the losses (which zombie companies are rarely able to do), the company will likely fail.

- Big project out of control – a key project is either failing or draining cash flows. For a zombie company that does not have a good handle on its financial situation, the big project will likely continue to cost the company more money than it makes, until the business fails.

- Sickness – illness such as depression may hold back the proprietors, diverting their attention away from the business and causing a decline in morale, productivity and accountability which can lead to losses.

- Fraud – key person in the business takes business opportunities or cash away from the company. If fraud is not detected early, it can be almost impossible to recover from.

- Constraints – a key issue that the business has faced becomes mission critical. Extra constraints are unlikely to be handled well by a business that is out of touch with its finances and people.

These problems would not spell the end for a securely profitable company, but for zombies, they are compounded by a lack of up-to-date financial information, insufficient working capital and creative accounting. This means the scale of problems are rarely properly understood, and businesses are not in a position to work towards addressing them.

How can zombie companies fix their problems?

The typical services that help the proprietors to get a handle of their situation are:

Analysis of the problem

- Root cause analysis regarding profit margin improvement

- Staff evaluation, termination and new hires

- Improved management accountability and staff role alignment

- Improvement of customer mix targeting

- Dealing with creditors

- Representing the proprietors in ongoing litigation

- Working with accountants to ascertain their financial position

- Evaluating financing and equity injection options and offers

- Considering whether a restructure is feasible

- Evaluating the risk to the personal assets of directors and proprietors

- Recovering claims owing to the company

- Discussions with stakeholders in the business

- Identification of toxic employees

Execution of a restructure

- Cashflow planning and rationalisation of expenses

- Termination of unprofitable customers

- Implementation of focus strategy to improve new clients taken on board

- Performance management of employees

- Sale or exit of business

- Hiring of fresh management

- Working with accountants to finalise accounts and undertake remedying transactions

- Drafting contractual and transactional documentation to improve the structure

- Negotiations with creditors and documentation of outcomes

- Engagement of an insolvency practitioner (liquidation or voluntary administration)

- Representation at creditor proceedings

- Termination of toxic employees

What has been the effect of COVID-19 on zombie companies?

Zombie companies are especially vulnerable to being tipped over the edge by external forces impacting their sales and profitability. COVID-19 is likely to push many zombie companies into insolvency. However, there are several support measures and leniencies that are keeping zombie companies alive, including:

- JobKeeper benefits

- Mandatory codes of commercial rent relief

- Temporary relaxation of the application of the safe harbour from insolvent trading

- Limitations on statutory demand collections (amounts and time frame)

- Loosened credit lending requirements from banks

- Low interest rates (RBA)

- Regulatory/government body relaxation (ATO, ASIC)

While these changes have allowed zombie companies to weather the adverse market for a time, they must use these changes as an opportunity to restructure, or face the consequences later. When support drops off, it is unlikely that zombie companies, who were already struggling before the pandemic, will be first on the priority list for governments and lenders to invest in and protect. The patience of these supporters in 2020 will thin as Australia faces a protracted recession.

With the COVID-19 relaxations in insolvency law (namely statutory demands and the safe harbour from insolvent trading) and temporary benefits (namely JobKeeper and Cashflow Boost – in part) being extended until December and insolvencies at lower rates than this time last year, it is unclear when and to what extent zombie companies will start to fall. Until the lifelines in the list above are scaled back significantly or phased out entirely, it is likely that many zombie companies will continue to cling to life throughout the pandemic.

What will happen to zombie companies when support drops off?

Zombie companies will be the first to fail when the support begins to fall away (although it is currently unclear when that will be).

Early statistics from CreditorWatch reveal that over April and May 2020, the number of external administrations was 30% lower than it was in those months in 2019 – meaning around 600 businesses that would normally have collapsed in that time frame did not. Instead of a light shower spread over time, there will be a sudden downpour when the artificial support systems are removed and business resumes ‘as usual’.

According to the ASIC, as of late September, only 6398 businesses have been wound up so far in 2020, an overall decline of 21%. However, this decline is likely to worsen, as winding up applications fell 65% in August 2020 from August 2019 figures. In the first week of September, 75% fewer companies entered voluntary administration than did in the same week in 2019.

Overall, Deloitte has estimated that up to 240,000 companies could fail due to COVID-19, which would be almost a 3000% increase on a typical year. There is no verifiable empirical model, however, that can be use to explain this estimate – so in our opinion, it is a guess.

There are concerns that the insolvency profession will not be able to handle the influx of insolvencies when it comes, given that many insolvency firms themselves are currently being propped up by government support due to a lack of work brought about by the artificial support allowing companies to survive.

So, what is the verdict on the extension of the business protection provisions? It depends on who you ask.

According to creditor managers, it was a poor move that will draw out economic shock.

- Nick Pilavadis, CEO of the Australian Institute of Credit Management: any payments recovered now are at risk of being clawed back later through the insolvency process… longer payment times and lower cash receipts are now being reported… as debt increases, so too does the likelihood that small businesses will lose assets that have been put up for collateral, such as the family home.

- John Winter, CEO of the Australian Restructuring Insolvency and Turnaround Association: the insolvency industry may struggle to handle the amount of insolvencies in 2021… around half of insolvency firms are now on JobKeeper themselves… bad businesses are being propped up, not paying good businesses and thereby placing those good businesses at risk… if nobody investigates the failed businesses, the amount of phoenix activity will rise significantly.

- Brent Morgan, Director of Rodgers Reidy (International Insolvency Firm): it is likely that the tax office is now sitting on a stockpile of statutory demands to be released in 2021… the insolvencies might all happen at the same time.

- Patrick Coghlan, CEO of CreditorWatch: financially troubled businesses are staying alive partly because the law firms that would normally press insolvency actions have themselves been forced to lay off staff and partly because the court system that would handle those actions has been heavily restricted… zombie companies have no future once government support is removed.

According to government figures, it is a necessary lifeline for viable small businesses despite the impact of zombie companies.

- Josh Frydenberg, Treasurer: the extension will “help to prevent a further wave of failures before businesses have had the opportunity to recover”.

- Kate Carnell, Australian Small Business and Family Enterprise Ombudsman: “these necessary measures give otherwise viable small businesses more time to recover, preventing a wave of unnecessary insolvencies… while we support this temporary relief for financially distressed businesses, there will also be a number of zombie businesses kept artificially afloat as a consequence”.

Essentially, the impact of the government support, relaxed provisions and hesitance to recall debts cannot last forever. When all of these measures are phased out, many people will likely be out of work all at once, at a rate dependant on how the government, banks and other credit and regulatory bodies decide to stagger (or not) the process. This will put further pressure on JobSeeker and likely correspond with a decline in economic activity, hurting other viable industries and businesses as a consequence. In the meantime, these zombie companies are chewing through valuable economic resources (especially given the recently announced budget deficit) which will likely be unrecoverable upon their inevitable insolvency.

What is the impact of zombie companies on the wider economy?

According to a 2019 report from KPMG, one in seven companies listed on the ASX trades in zombie territory – this number is likely to be much higher now due to COVID-19. Also consider that SMEs are more likely than larger, established companies (i.e. those listed on the ASX) to be zombies; from this, we can infer that a significant percentage of operating Australian businesses are zombies, and zombie companies pose a significant risk to our economy.

According to the Organisation for Economic Cooperation and Development (OECD) zombie companies generally cost the economy by hampering productivity growth, diverting credit, investment and talent away from efficient and sustainable businesses. They also slow the rate at which best practices and new technologies are adopted across an economy. In Australia, zombie companies hold an estimated $5 billion in shareholder capital, which could be more effectively invested elsewhere. At a company level, zombies, which are inherently uncompetitive, negatively impact pricing power, reduce return on equity and have the effect of lowering market valuations of otherwise healthy companies.

COVID-19 and the associated protective lifelines for businesses (including zombie companies) has served to exacerbate the potential damage. Support has to fall away at some point – the current strategy of ‘kicking the can down the road’ can’t last forever. Even if this support is phased out in a staggered or gradual manner, it is still likely to result in an unmanageable increase in unemployment (which some economists fear could rise above 10%), unrecallable debts, lower consumer spending and the insolvency of viable businesses who traded with the zombies.

How should directors decide whether to restructure or wind up a zombie company?

If a company is a zombie, and directors make no changes to the business and do not enter external administration, it will inevitably fail at some time. So, how far gone is too far gone? In order to determine whether a zombie company can be salvaged through a restructure or whether it would be economically wiser to proceed immediately to winding up, directors should ask themselves a series of questions. The first steps usually employed are on the expense side to cut costs and the income side to employ a more focused strategy.

Zombie Checklist:

- What are the market forces we need to be listening to?

- e.g. supply/demand, government, speculation/expectation, international transactions

- What do the movements in these market forces reveal about the industry?

- How can we tailor our offering to be competitive in this market?

- Can the company meet these forces? At what cost?

- What are the existing debts?

- What is owed to whom?

- What is the nature of the relationship with the creditor?

- Can a repayment plan or debt forgiveness be negotiated?

- What is the estimated return of a wind up vs. a restructure?

- How long would a restructure take to pay off and can money be sourced to fund it (difficult for SMEs)?

- What will be the effect on the goodwill value?

- What kind of advice will be required?

- What returns will a wind up generate?

Directors of zombie companies should seek out pre-insolvency advice from a professional in order to decide what the best course of action is (restructure or wind-up) for their company. Read our article about choosing a pre-insolvency adviser for more information.

A restructuring should be supervised by an adviser, and once complete should be given the best chance at success with the ongoing support of a turnaround board. A restructure may be conducted in several ways, including:

- Through the safe harbour from insolvent trading (informal arrangement)

Read our article Navigating the insolvency safe harbour: Complete guide for SMEs for more information.

- Pre-pack insolvency arrangement: creating and executing a restructuring plan through a sale of company assets to a new company for fair market value

Read our whitepaper on pre-pack insolvency arrangements for more information.

- Obtaining further/rescue finance (safe harbour can support this)

- ‘Debtor in possession’ restructuring (from January 2021)

Read our article on the new debtor in possession restructuring framework for more information.

Alternatively, there are two options for a winding up:

- Voluntary administration

Read our article on voluntary administration for more information.

- Liquidation

Read our article on liquidation for more information.

Causes and symptoms of zombification: John Argenti

There are eight main causes of zombification/business failure.

- Management

Effective management is key to the success of a business. Without someone overseeing the business function as a whole, it can be very difficult to spot big picture problems which can lead to zombification or insolvency. According to Argenti, there are six main issues that can occur with management.

- One-man rule: the chief executive dominates colleagues instead of leading them, reducing morale and limiting effectiveness and collaboration.

- Non-participating board: poor engagement by the board in company matters leads to things being missed.

- Unbalanced top team: senior staff do not have a spectrum of skills or a diverse educational background which means they have gaps in knowledge about industry, business or people which lead to failures.

- Lack of management depth: broadly, a lack of management training/skills which leads to poor management.

- Weak finance function: lack of utilisation of finance experts which means that finances are not managed and planned accordingly, leading to a lack of ability to adapt to business challenges and a lack of awareness of the financial position.

- Combined chairman/chief executive: combining roles creates a lack of accountability at the top of the management hierarchy due to too few people being involved.

- Accountancy information

Accurate accountancy information is vital for a business to understand its own position. Without it, directors will not be able to tell whether or not they are making a meaningful profit. The four most crucial types of accountancy information are:

- Budgetary control: effective use of budgets to plan the business’ path forward (i.e. growth, saving, new initiatives/products, etc).

- Cash flow forecasts: early detection of potential shortages so that changes to spending can be made if losses are predicted.

- Costing systems: effect of product cost on profit should be known and managed so that pricing is accurate.

- Valuation of assets: accurately determine the financial position and how much money could be recouped from a liquidation or sale of select assets.

- Change

A weak business will not be well equipped to respond to change, thereby indicating that they may be a zombie company. There are five main types of change that a company should be able to adapt to:

- Competitive trends: developments in products or competitors (i.e. announcement of new products or mergers of competitors)

- Political change: a shift in governmental and/or international attitudes towards business (if this is negative, it can impact resources, markets and financing)

- Economic change: macro-economic factors such as foreign exchange rates, inflation, interest rates and the economic cycle can affect profits

- Societal change: changes in lifestyle or beliefs (i.e. climate change/consumer protection) can shape consumer behaviour

- Technological change: developments in technology within the industry could increase competition, research and development costs and change the nature of the business

- Constraints

Generally, these are imposed by external parties on the way the company trades or how it seeks to respond to change. They relate to the perception of the business.

- Overtrading

A company overtrades when it increases turnover at the expense of profit margins in the blind pursuit of expansion. Overtrading can force the company to over-borrow to finance the continued overtrading.

- The big project

An undertaking that is large compared to the resources of the company. The project fails because costs and times are underestimated or revenues overestimated.

- Gearing

Increasing the amount of debt beyond the responsible limit (this amount will differ for each business and industry). A company with high debt might only be able to cover the interest and create a burden on the company’s resources if the economy suffers a decline.

- Normal business hazards

Events which clearly cause the failure of companies but being normal, foreseeable hazards of any business, should not have had the capacity to cause failure. These events cause failure because the company is already weak (i.e. a zombie), and may include a fire on the premises or movements in market share.

There are four main symptoms of zombification/business failure:

- Financial ratios

Financial ratios can be useful to identify symptoms of failure, but while they might show something is wrong, they do not provide enough evidence to predict collapse. Inflation can seriously erode their effectiveness and they are also vulnerable to ‘creative accounting’ and thus not entirely reliable. Financial ratios include:

- Altman’s Z

- Working Capital/Total Assets

- Retained Earnings/Total Assets

- Earnings Before Interest and Tax/Total Assets

- Sales/Total Assets

- Market Value of Equity/Book Value of Total Debt

- Current ratio or current assets/current liabilities

- Quick ratio or cash plus debtors/current liabilities

- Profit/sales or ‘margin’

- Sales/fixed assets

- Cash flow/debt

- Stock + debtors – creditors/long term capital

- Long term loans + equity capital/fixed assets

- Price/earnings

- Share price/share index

- Various industry specialised ratios

- Creative accounting

Managers use creative accounting tactics to hide the extent of the company’s problems, which reduces the effectiveness of financial ratios (above). Creative accounting techniques (which amount to accounting fraud, which is illegal) can include:

- Delay in publishing results

- Capitalising research costs

- Continue paying dividends (even if equity or loans are needed to do so)

- Cut expenditure on routine maintenance until a major renovation is needed which can be treated as capital

- Leasing and hire agreements do not need to be shown as loans in some countries, reducing apparent gearing

- Treat extraordinary income as ordinary and ordinary expenditure and extraordinary

- Instruct subsidiaries to increase dividends to the parent company

- Bring more results from subsidiaries into consolidated accounts progressively

- Retaining company assets under names of personal proprietors

- Inaccurate asset valuation/bribing auditors

- Capitalising training costs, interest charges on loans, IT costs and advance payments

- Use inflation as a smokescreen to revalue assets

- Meet company debts out of proprietor’s pocket

- Value stocks of finished products at market selling price instead of cost

- Hold back output before inspection

- Invent customers and transport

- Set a sales target; if sales fall short, take the percentage short out of this years’ accounts and defer to the next year

- Fail to revalue assets so that depreciation looks adequate compared to book value even though it is too low

- Non-financial symptoms

There are many non-financial symptoms exhibited by failing companies, although companies that are not failing may also display them. These will be very different for each industry and even each company. However, examples include low morale, decline in service or quality, and marking down of the company share price.

- The last few months

The period before which the company collapses, when it exhibits multiple symptoms of increased severity. By this point, it is too late to take effective action to save the business.

The three types of zombie company

According to John Argenti in ‘Corporate Collapse: Causes and Symptoms’, there are three distinct types of failed company. We have named and explained them below:

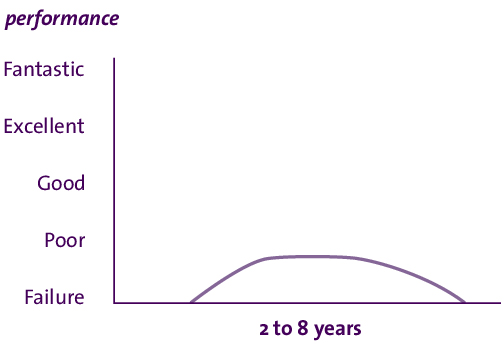

Type 1: The Submarine

This type only applies to new companies (2 – 8 years old). This type of company charts a continuously low path before ‘sinking’ – i.e. it was a zombie company right from the start and never made a meaningful profit. The problems with the company were there from the beginning, and there was likely nothing of value to save in terms of goodwill. This is a less common type of zombie company given its age, but it clearly fits the description.

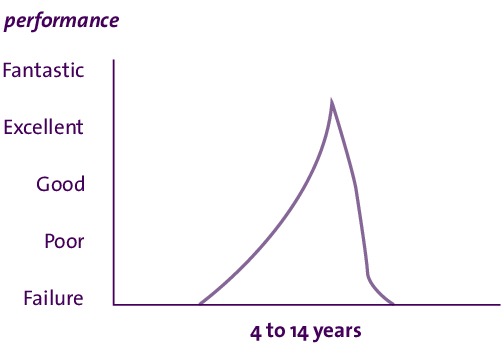

Type 2: The Space Shuttle

This type applies to young companies (4 – 14 years old). A type 2 company looks similar to a type 1, but it is likely that the proprietor has an outstanding personality. The business trajectory is different: it launches to great heights before rapidly declining. These companies are rare and are typically characterised by unsustainable growth. They cannot really be characterised as a zombie company because they lack the extended ‘plodding along’ period: instead, they fail fast and dramatically.

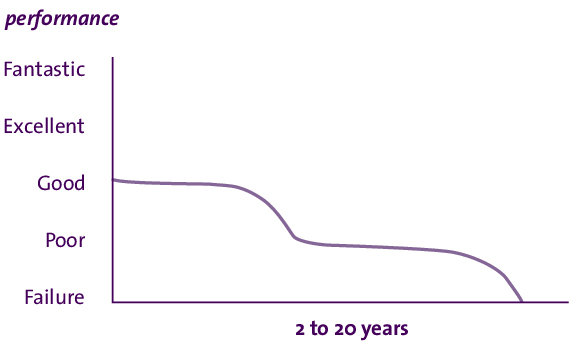

Type 3: The Kite

These types of failures occur in companies that have been trading for many years – often decades. However, the business will generally only remain operational for 2 – 20 years once entering the zombie phase. Type 3 is the classic zombie company, charting the complex path of ‘good performance’ followed by losses, a plateau and an ultimate failure.

Company survival kit

To fix a company (i.e. restructure it) you must first address the symptoms (damage control) and then address the causes (long term fix). In the first stage of damage control, it is easier to reduce expenses than quickly build up income through a loan (which a struggling company is unlikely to be approved for) so companies should start here. It is important to manage by objectives (identifying objectives and focusing) in order to keep on track and focus on one task at a time. Ultimately, businesses need to change their competitive position. This is a slow-moving ship; it is better to not try and change strategy completely, but make small, manageable, incremental changes to take advantages of the existing customer base and reputation the company has.

Cultural signs of a zombie company

There are several cultural signs that may indicate a company is a zombie. These include:

- Complacency

- Arrogance

- Condescension (within business and to competitors)

- No desire to learn about new technology or new strategies

- Unwavering pursuit of a dated vision

- Reluctance to innovate in the name of loyalty, i.e. “we know what the customers want better than they do”

- Relentless positivity

- Shunning criticism (internal and external)

- Reliance on debt rather than growth through retained earnings

- Lack of investment

- In research and development

- In progress

- In people

Case study: Darrell Lea

Beloved Australian chocolatier Darrell Lea is over 90 years old in 2020 and remains a trusted and iconic brand. But in 2012, all of that was at risk when the company collapsed. It entered voluntary administration and Darrell Lea’s 700 staff faced huge uncertainty, with half of the brand’s store fronts closing and hundreds ultimately losing their jobs.

The company was purchased for around $25 million by Queensland’s Quinn family, serial entrepreneurs who executed a significant restructure transforming this company from a zombie into a reborn success – in 2018 the company was sold again to the tune of $200 million. The Quinns did not purchase the remaining store fronts, resulting in 27 further closures and over 400 redundancies. Ultimately, staff numbers were reduced from over 700 to around 200.

Darrell Lea was a Type 3 zombie company for many years before its collapse. It had excellent brand recognition, but failed to adapt to changing consumer behaviour. Darrell Lea was poorly managed before 2012 – not high end enough to make their store front experience and presence profitable (like competitors Haigh’s Chocolates) but also failing to take advantage of the tendency of shoppers to impulse buy their chocolate by positioning themselves in retailers like supermarkets or petrol stations. Their products remained largely unchanged and unsuited to the way purchasers consume their chocolate. The price of maintaining so many staff and shop fronts, their poor marketing strategy which did not take adequate advantage of their brand name and their lack of new products is what likely caused their failure.

The Quinn family, in realising the untapped potential of this Aussie favourite, executed an extremely successful turnaround, quadrupling the company’s value in just six years.

By consolidating the team, abandoning shop fronts and doing distribution deals with IGA, David Jones, Big W, Australia Post and independent distributors (most notably pharmacies), Darrell Lea was able to improve the availability of their product to older Australians familiar with the brand who frequent independent grocers, post offices and pharmacies. This is likely what led to their huge success.

Since the 2018 sale, Darrell Lea has only soared higher. The introduction of its chocolate block range in 2019, featuring beloved flavours including Rocklea Road, Liquorice, Fruitier and Nuttier, Caramel Craving and Peanut Brittle has been hugely successful, positioning the product as a major domestic competitor to Cadbury’s Marvellous Creations.

The Darrell Lea story is an excellent example of how zombie companies can be effectively restructured with the right market insight and turnaround plan.

Case study: Borders Books and Angus & Robertson

REDGroup Retail, owner of Borders Booksellers and Angus & Robertson, once accounted for 20% of Australia’s book market. Another classic example of a type 3 zombie, the parent company of both booksellers entered voluntary administration in 2011, and the brands were never revived. So what went wrong?

The failure was blamed on the online book market (i.e. Amazon, Booktopia, the Book Depository), a strong Australian dollar, import restrictions, high rental prices for store fronts and overpriced products.

However, all of these problems could have been addressed by good management, which these booksellers did not have. Strategic marketing failures and an unwillingness to adapt from traditional bookseller to online retailer (informed in part by a lack of knowledge about changing consumer behaviour and the move towards the e-book market) is what ultimately closed the book for this business.

REDGroup made negative profits for three consecutive years (08, 09, 10) before its collapse – a clear sign that management refused to recognise and address the signs of zombification before it was too late. Importantly, this poor performance was already occurring before the Australian dollar began to strengthen and before e-books began to take off.

The period from 2008-11 was one of great change for booksellers, and well managed businesses took note and adapted. Borders and Angus & Robertson failed to list their books online or include e-books in their products. As a result, their brick and mortar stores added less value – given their wide target market (i.e. unspecialised), the store front experience didn’t add value to the product range, costing the company dearly. In 2010, REDGroup’s online sales only accounted for 4% of total revenue.

REDGroup did not invest in marketing, management, staffing or products that would assist them in transitioning their expertise in traditional retailing to the changing market. By sticking their heads in the sand and continuing on with what they knew (i.e. adopting a ‘we know what the customers want better than they do’ approach) they carved their own tombstone. Even the older demographic, generally reluctant to accept change, were faster to adapt to the new way of reading books than Borders and Angus & Robertson were, accelerating the entire process.

However, REDGroup did at least try to enter the e-book market by working with Indigo (Canada) to sell the Kobo e-reader. However, this product was far less attractive to consumers than the Kindle and iPad, and ultimately did not sell well – something that could have been predicted with a better understanding of the online market.

REDGroup missed a key opportunity to become the Amazon of Australia by being better attuned to the market. Instead, this zombie company failed spectacularly thanks to their ignorance and resistance to change.

Australian management problems

Much of the way a business is run can be traced back to culture, which itself is informed by the attitudes and beliefs of those that run the business. There are several key management problems that are unique to Australia, and especially Australian SMEs. These include:

People try to be mates, not managers

The Australian notion of mateship and larrikinism might make friends, but it won’t make good workers. Managers who seek to be friends with their staff are likely to find difficulty commanding respect and curating authority. While civility, kindness and understanding from managers is very important in creating a good workplace culture, it should not be at the expense of professionalism and clearly defining the relationship.

Barbecue approach to management

Australians love a barbecue. They taste great, and they’re easy – all you have to do is stand there in your thongs with a beer in one hand and tongs in the other, occasionally flipping the sausages while having a side conversation with a mate and plenty of freedom to watch your kids playing. While this laid-back, casual approach works just fine for cooking a Sunday night meal, it doesn’t work for managing a business. If managers are focusing on something else, and only glancing over at the business every now and then to make minor changes, huge problems can be missed and you won’t realise something is burning before it’s too late.

Australian exit rates

While some struggling businesses do not become insolvent, this doesn’t mean they don’t end – and many zombie companies wrap up this way (i.e. exit or cessation as opposed to formal insolvency). This is the case for many different reasons – the Productivity Commission’s 2015 Report on Business Set up, Transfer and Closure goes into them in depth, but some will be summarised here.

- Lack of innovation: only a small proportion of Australian businesses are truly innovative. The Commission estimated that less than 2% of businesses (new and existing) introduced a product that was ‘new’ to the World or Australia in 2012-13. Innovations in operational processes or marketing strategies were even less common, while the protection of intellectual property rights through patent applications was only sought by 0.1% of businesses, below the reported global rate.

- Business exit: the vast majority are voluntary, and 90% are not due to formal insolvency. Businesses exit for a range of reasons, including family succession, sale of business, merger, transfer to employees, management buyout, initial public offering, private placement and cessation. Small businesses account for over 99% of all set-ups and closures. Entry and exit rates are higher for small businesses and unsurprisingly, new businesses have a lower chance of survival than already established businesses.

- External conditions: The set-up, transfer and closure of businesses are either fostered or hindered by the existence and interaction of a number of factors (i.e. structural, regulatory, cultural and financial) that together make up a business ecosystem. When these factors do not align, business exit is common.

Japan 1990s: zombie loans

In the 1990s in Japan, there was huge resource reallocation in an attempt to combat the decade of economic recession. The contribution of resource reallocation to aggregate productivity growth declined in the early 1990s, eventually becoming negative in the late 1990s when the financial crisis occurred. Misdirected lending by banks to failing firms (known as zombie lending) allowed them to avoid reducing production inputs and continue trading as they had been before. Studies have argued that without zombie lending, aggregate productivity growth could have been considerably higher. The move by banks to bail out zombie firms instead of winding them up also created significant stagflation, devaluation and unemployment.

This part of history should be considered carefully in light of Australia’s current COVID-19 economic position. As discussed above, many job-saving initiatives and lifelines championed by the government, banks and landlords have allowed zombie companies to continue trading long past their use by date. Experts predict this may result in stagflation, devaluation and unemployment, just as occurred in the 1990s in Japan.

Conclusion

Zombie companies may seem harmless, but they pose a significant risk to the economy and society when they are artificially propped up. This article has covered what causes zombie companies, where and why they pop up, how to spot one, and what the risks are. The term ‘zombie company’ is sure to be one Australians will become more and more familiar with as the unintended economic effects of the country’s response to COVID-19 are realised. SME directors of zombie companies also face an uphill battle that will result in stress, financial loss and wasted energy and resources.