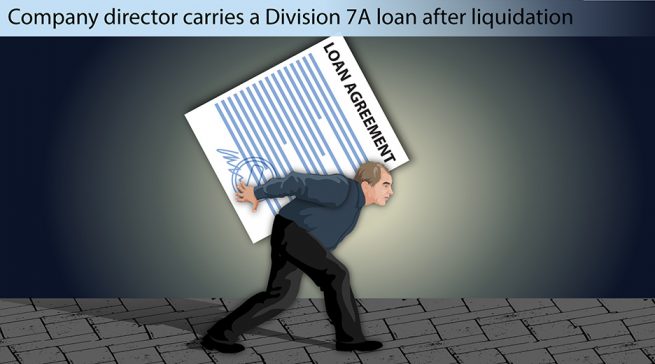

What happens to a Division 7A loan in a winding up?

In a winding up, it is the duty of the liquidator to realise all assets of the company. This includes outstanding loans to shareholders and directors. In this article, we explain what happens to some of these loans — loans that comply with Division 7A of the Income Tax Assessment Act 1936 (Cth) — in the winding up of a company.