Restructuring service businesses in Australia is all about intangibles

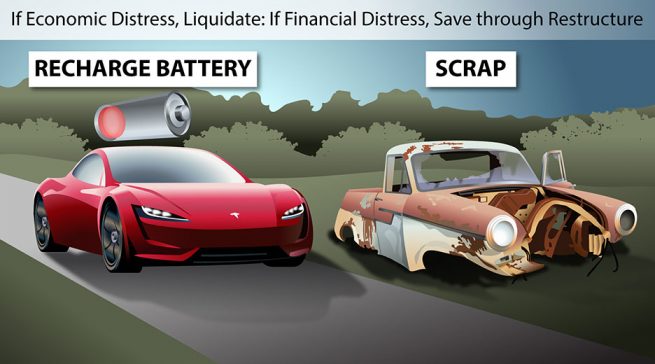

Debt and asset restructuring for financially distressed companies has taken on a new significance in Australia with the introduction of a new process last year — small business debt restructuring.