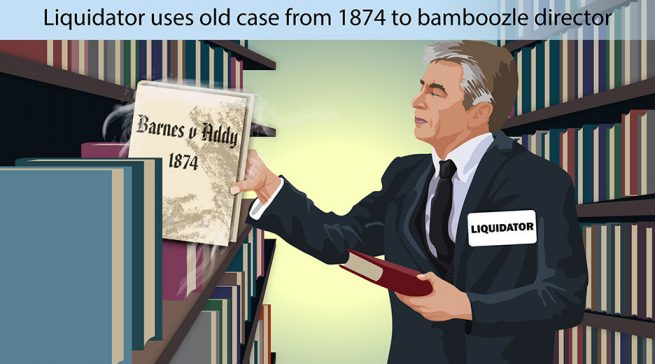

Liquidator fraud recovery using Barnes v Addy

If a liquidator is appointed to an insolvent company, and believes assets have been depleted due to fraud, what can they do? Even if the crime of fraud can be proven, this does not necessarily aid the liquidator in recovering assets. Here we look at the option for liquidators to use the concepts of ‘knowing receipt’ and ‘knowing assistance’ established in the 19th century English case of Barnes v Addy to recover from third parties in cases of fraud. It is a difficult claim to defend because it is vague and open to broad interpretation when a director fails to keep adequate books and records before winding up.