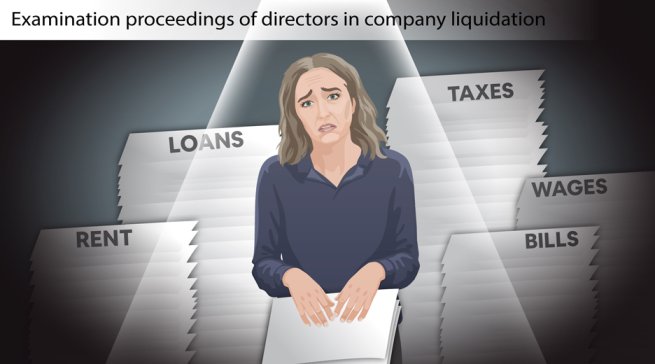

No One Expects the Liquidator’s Inquisition: A Director’s Guide to Public Examination

Public Examination is a formal Court-supervised process where Liquidators question Directors on the matters leading to insolvency and any potential misconduct. Here we offer a complete guide on the Examination process in Australia.