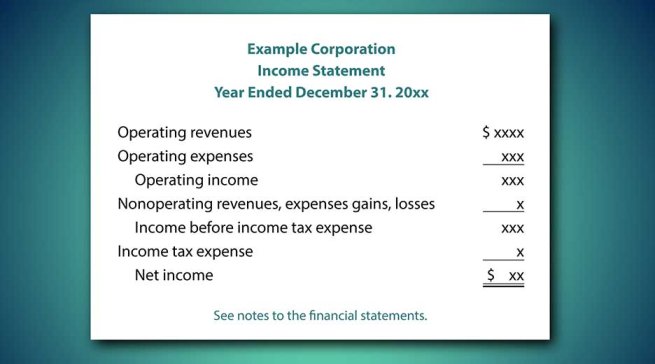

Client Journey — What the financial statements don’t tell you

Financial record-keeping and preparing financial statements are vital activities for small businesses in Australia. However, financial statements don’t tell you everything. Here we look at what the balance sheet and P&L statements leave out.