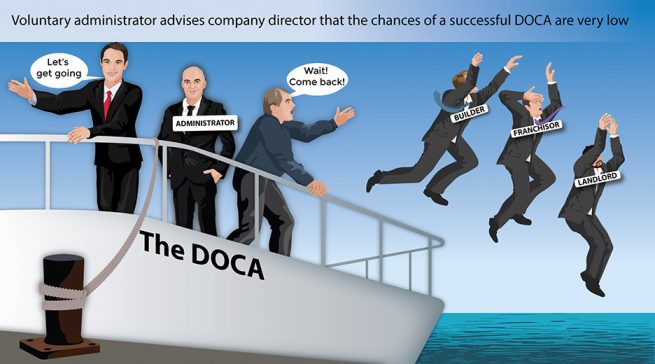

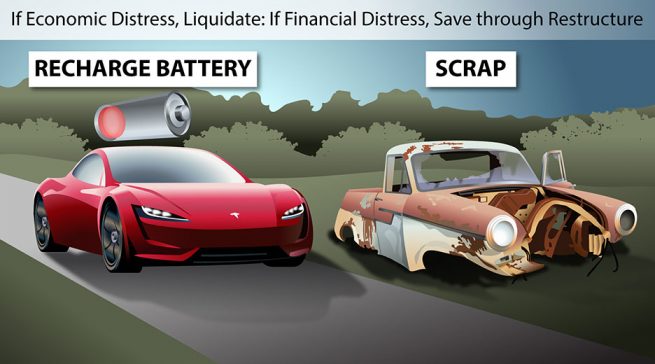

Fast track sales involve the voluntary administrator selling the assets of a business during a voluntary administration, instead of recommending a debt compromise or ‘Deed of Company Arrangement’. While a fast track sale in a voluntary administration is legal, it is relatively uncommon in Australia. Here we explain how fast track sales work, and consider whether they are a desirable feature of Australian insolvency law. If it occurs, company directors may feel betrayed by a voluntary administrator if they are expecting a debt restructure through a ‘Deed of Company Arrangement’.