Client journey 3 – You’re a technician with an entrepreneurial spirit

Technical experts with a flair for entrepreneurship are the key new business starters in Australia. Here we examine what success looks like for these types of business.

Technical experts with a flair for entrepreneurship are the key new business starters in Australia. Here we examine what success looks like for these types of business.

While big business get all the media attention, the Australian economy is driven by small businesses. Here we look at some of the challenges for small business, and suggest some ideas to help them in their business journey.

The Small Business Restructuring Process (SBRP) was introduced in Australia in 2021 as a streamlined process for insolvent small businesses. The objective of the process is to allow small businesses to put a restructuring plan proposal to creditors without losing control of their business.

The majority of Australian businesses are expertise-driven. We look at some of the difficulties that face expert entrepreneurs and what they can do to get on the right path for business success.

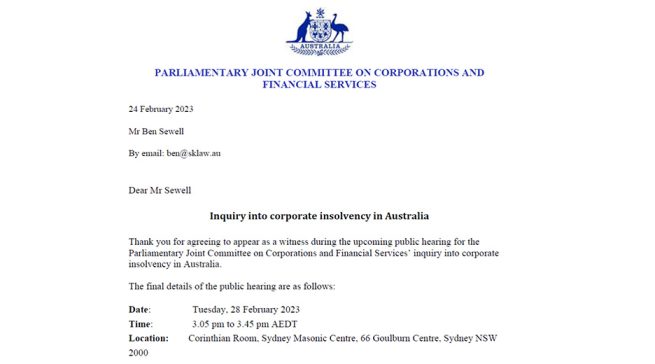

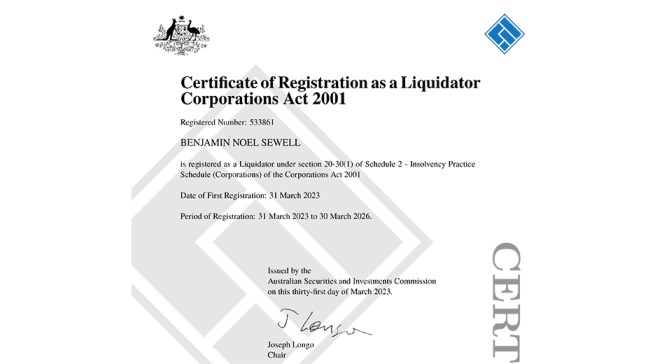

On 28 February 2023 Ben Sewell of Sewell & Kettle Lawyers was invited to give evidence for the Parliamentary Joint Committee on Corporations and Financial Services’ inquiry into corporate insolvency in Australia. The scope of the inquiry is quite broad,…

The firm is pleased to announce that on 31 March 2023 Ben Sewell of Sewell & Kettle Lawyers was registered as a Restructuring Practitioner by ASIC. Ben is only the second person in Australia to be registered as a Restructuring…

A major contributor to financial distress for small to medium-sized enterprises (SMEs) in Australia is poor budgeting. Here we look at a useful budgeting technique — the ‘three factor’ budget/forecast, and how this can be used by distressed businesses to turn things around and avoid insolvency.

Constructive trusts impact on corporate insolvency and bankruptcy by reducing the pool of assets available for distribution to creditors. Here we define constructive trusts, and look at their application in corporate and personal insolvency.

Recently I was interviewed by Heide Robson, a professional accountant and the founder of the Tax Talk Podcast (www.taxtalks.com.au) about business insolvency in Australia.

In a winding up, it is the duty of the liquidator to realise all assets of the company. This includes outstanding loans to shareholders and directors. In this article, we explain what happens to some of these loans — loans that comply with Division 7A of the Income Tax Assessment Act 1936 (Cth) — in the winding up of a company.

Minority shareholders in Australia are generally beholden to the majority shareholders. However, in some cases, minority shareholders of private companies do have recourse available to them. In this blog article, we look at the ‘minority shareholder oppression remedy’ available in section 232 of the Corporations Act 2001 (Cth), and the orders available to the Court in enforcing that remedy.

A dispute between shareholders can derail the small and medium-sized businesses that make up the bulk of the Australian economy. Here we explain how a shareholders agreement can help reduce the risk of serious dispute.