External administration in Australia: Voluntary liquidation compared to voluntary administration

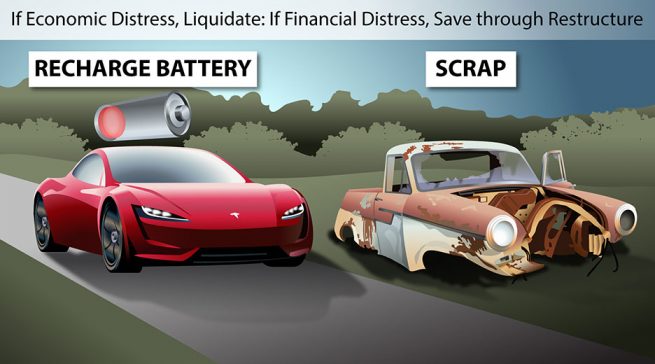

Voluntary liquidation (CVL) and voluntary administration (VA) have a range of pros and cons, relative to each other. Here we look at the advantages of voluntary administration, including the ability to turn around the business, director initiation and the breathing space it provides to directors. We compare this with CVL, which is generally more cost-effectiveand more streamlined than voluntary administration. It is also generally the more appropriate option where the business is unlikely to be saved through a restructure process. This overview is intended for company directors of small-to-medium sized businesses weighing up their options for external administration.